Tijana Ignjatovic, MA, PhD, Executive Director, Access & Pricing, applies the case study of Minjuvi to explore whether we can anticipate pricing and reimbursement for newly approved products months before HTA decisions are published.

_

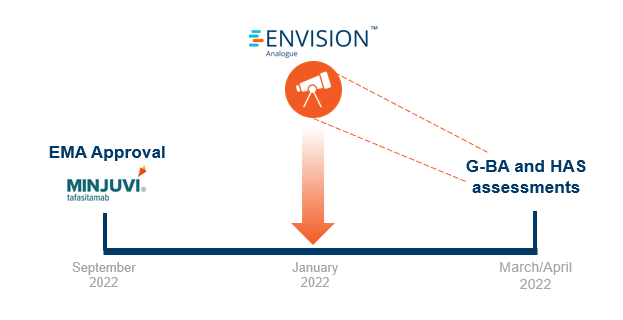

The below case study of Minjuvi in diffuse large B-cell lymphoma (DLBCL) showcases the predictive power of Envision, an innovative online platform that provides forward-looking evaluations and strategic guidance for market access viability. By leveraging our global payer network and stakeholder engagement surveys, Envision offers invaluable insights into payer perspectives, enabling proactive planning for successful product launches and optimized market access strategies. Below we show how Envision was able to provide valuable insights for products facing similar challenges to Minjuvi.

Introduction

_

Diffuse large B-cell lymphoma (DLBCL), the most common type of non-Hodgkin lymphoma (NHL), is an aggressive lymphoma that can arise in lymph nodes or outside of the lymphatic system. DLBCL is a rare condition, affecting approximately 2.5 in 10,000 people in the European Union (EU), which is the equivalent of around 128,000 people.

Due to the aggressive nature of relapsed or refractory DLBCL there is an unmet need for new therapies that can offer incremental survival gain with delay or prevention of disease progression. CAR-T therapy is efficacious in later lines of therapy but is high-cost and difficult to administer on a broader outpatient basis resulting in a real need for IV or oral drugs with high efficacy for these patients.

Rituximab-based regimens across most lines of therapy are standard of care and patients who relapse are eligible for allogeneic stem cell transplantation (ASCT) and/or clinical trials with novel agents. Patients with DLBCL can achieve durable complete response upon treatment with R-CHOP in the first line setting (curative intent). However, approximately 30–50% of DLBCL patients are not cured, as relapse is ≤12 months from initial treatment, with second line therapy proven to be even more challenging in delivering meaningful benefit to patients – Overall Survival (OS <20%).

In September 2021, Minjuvi received EMA approval for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT) in combination with lenalidomide followed by MINJUVI monotherapy.

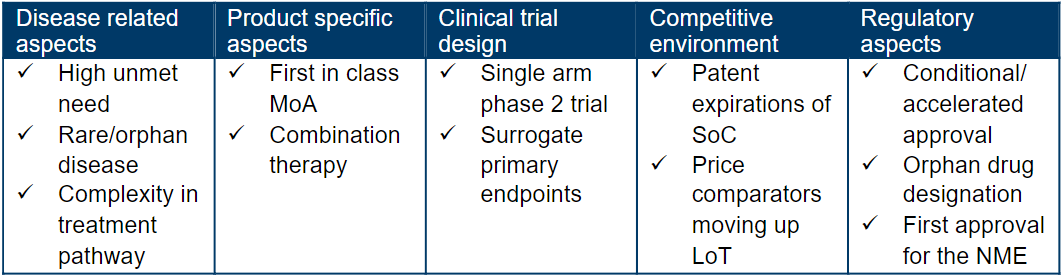

What is the analogue profile of Minjuvi?

_

_

Forecasted pricing and reimbursement for Germany and France

_

Shortly after regulatory approval, we leveraged our global payer network and stakeholder survey platform (RPR) to get payer insights on Minjuvi’s access potential. We surveyed five payers per market of interest on the following:

- Clinical value (including unmet need, trial design, efficacy, and safety)

- Competitive landscape (therapeutic value and comparative positioning)

- Access potential

- Price potential and appropriate comparators.

With 2-3 months in advance of HTA publications, our research forecasted poor pricing and reimbursement potential for Minjuvi in France and Germany.

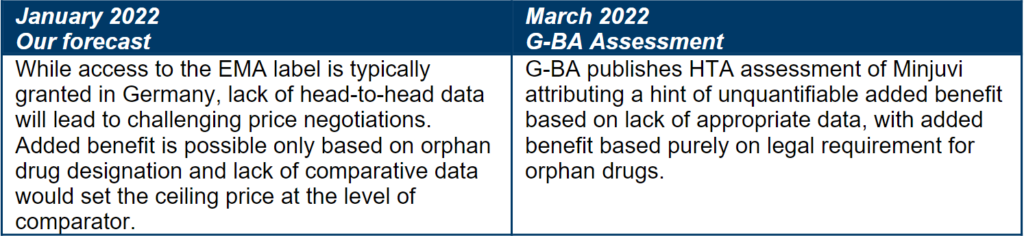

Forecasted price and access in Germany

_

_

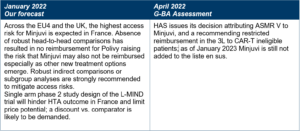

Forecasted price and access in France

_

_

What can products with similar characteristics learn from Minjuvi?

_

Lack of comparative data

Minjuvi was approved based on a single-arm Phase 2 study. Lack of comparative data is a frequent situation for many oncology products and can have major implications for a product’s price potential in most markets. Developers of oncology assets with similar evidence base need to be prepared for challenging pricing negotiations, advisably by avoiding excessive pricing to minimize risk of payer and clinician pushback, especially when seeking access based on single-arm trial data or immature OS evidence.

Even in patient populations with high unmet need for new treatment options, payers still seek comparative data. Therefore, planning for comparative data availability at launch will help optimize pricing and access outcomes, especially in France and Germany.

If earlier access is sought based on single-arm Phase II trial data, robust indirect comparisons, and willingness to engage in conditional or managed access (e.g. innovative contracting or risk-sharing agreements) will be key.

Orphan status is not enough for a price premium

Minjuvi’s orphan drug designation has the potential to boost its price potential in some markets, especially Germany where it will be deemed to have an added benefit by law. Oncology drugs targeting niche indications frequently receive orphan drug designations which may result in a more favorable price potential, however as illustrated by Minjuvi’s case, there is limited appetite to award a price premium based on the orphan drug status alone.

What about CAR-Ts?

Minjuvi is entering into an indication where CAR-Ts are used in later lines of treatment but may be moving into earlier lines in the future. While for now, CAR-Ts are not seen as relevant price comparators for Minjuvi due to differences in the line of therapy and one-off vs chronic use, payers will seek to see differentiation of new therapies vs. CAR-Ts in terms of patient eligibility, or AE profile and overall costs of care. This will become especially relevant if CAR-Ts demonstrate attractive CR rates in earlier lines of treatment.

Subgroup analysis in patients eligible vs. not eligible for CAR-T therapy will be particularly relevant going forward as CAR-Ts move up in the treatment paradigm

Brand-brand combination cost concerns

Combination use with another branded agent significantly curtails Minjuvi’s price potential, given the lack of strong added value demonstration based on a single-arm trial. With brand-brand oncology combinations being a top cost-containment payer priority, monitoring for any future changes in payer policies, including for management of combinations from different manufacturers will be critical.

Key takeaways

With the gap that exists between regulatory approval and HTA decisions, there lies an opportunity to gain timelier insights to inform regulatory, HEOR, and market access strategy. By learning what payers think about newly approved products, their evidence packages, and key strengths and weaknesses, manufacturers can incorporate commercially-oriented insights into their development and access plans. What’s more is that manufacturers can learn how payers react to different analogue situations which might be common across many indications.

If you’d like to learn more about Envision and how we proactively run payer research on the latest oncology drugs with expert insight from our market access and pricing consultants, please get in touch via this form or email solutions@genesisrg.com.

Watch Envision: an introduction